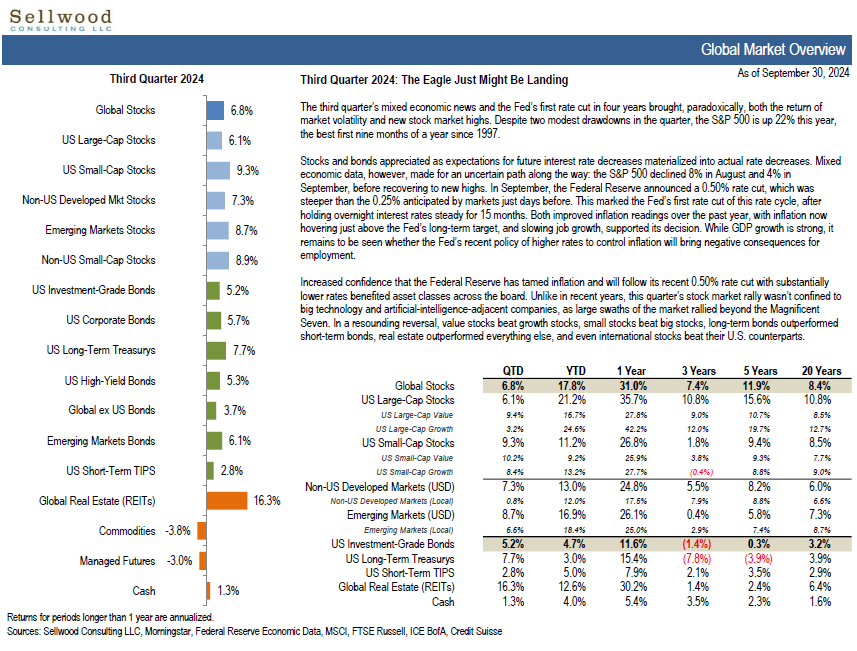

Third Quarter 2024 Market Snapshot

The third quarter’s mixed economic news and the Fed’s first rate cut in four years brought, paradoxically, both the return of market volatility and new stock market highs.

Second Quarter 2024 Market Snapshot

Second Quarter 2024: Artificial Intelligence or Artificial Highs? The second quarter of 2024 capped a strong first half of the year, with the artificial intelligence (“AI”) frenzy propelling stocks to gains despite a backdrop of tempered expectations for Federal Reserve interest-rate cuts. The S&P 500 climbed over 4% in the quarter and 15% in the

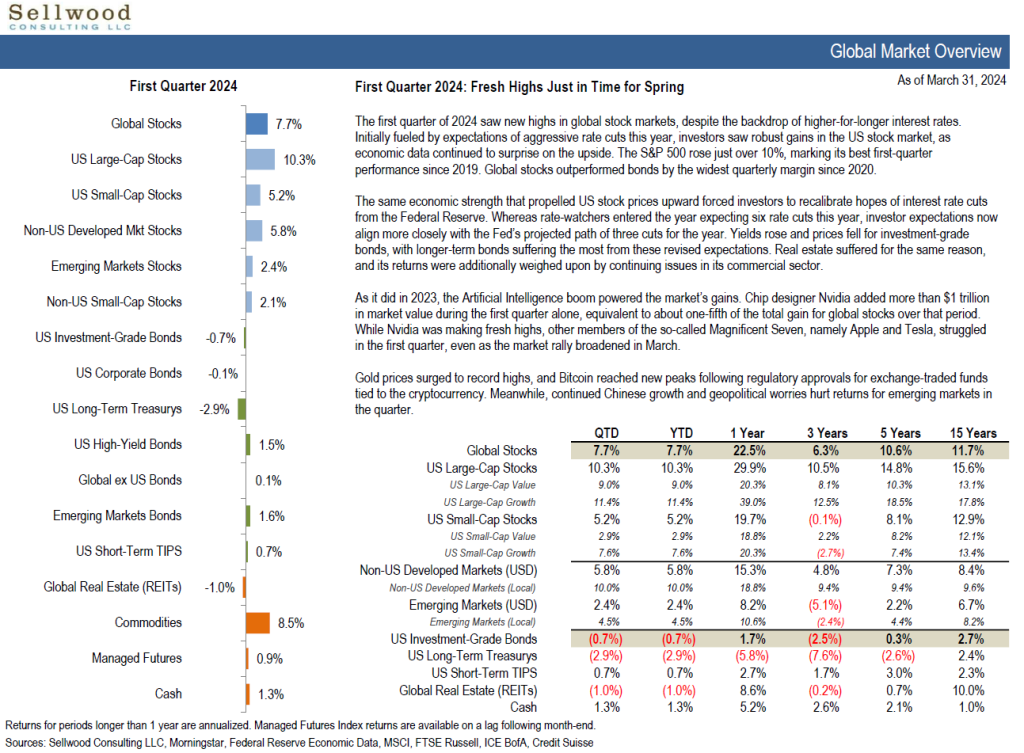

First Quarter 2024 Market Snapshot

The first quarter of 2024 saw new highs in global stock markets, despite the backdrop of higher-for-longer interest rates. Initially fueled by expectations of aggressive rate cuts this year, investors saw robust gains in the US stock market, as economic data continued to surprise on the upside. The S&P 500 rose just over 10%, marking its best first-quarter performance since 2019. Global stocks outperformed bonds by the widest quarterly margin since 2020.

2024 Capital Market Assumptions

Sellwood’s 2024 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

The Magnificent Seven and Equity Market Concentration

In the 1960 film, “The Magnificent Seven,” an undersized group of seven gunfighters gallantly fought to liberate a small village from a gang of marauding bandits. As the movie’s advertising poster proclaimed, “they fought like seven hundred.”

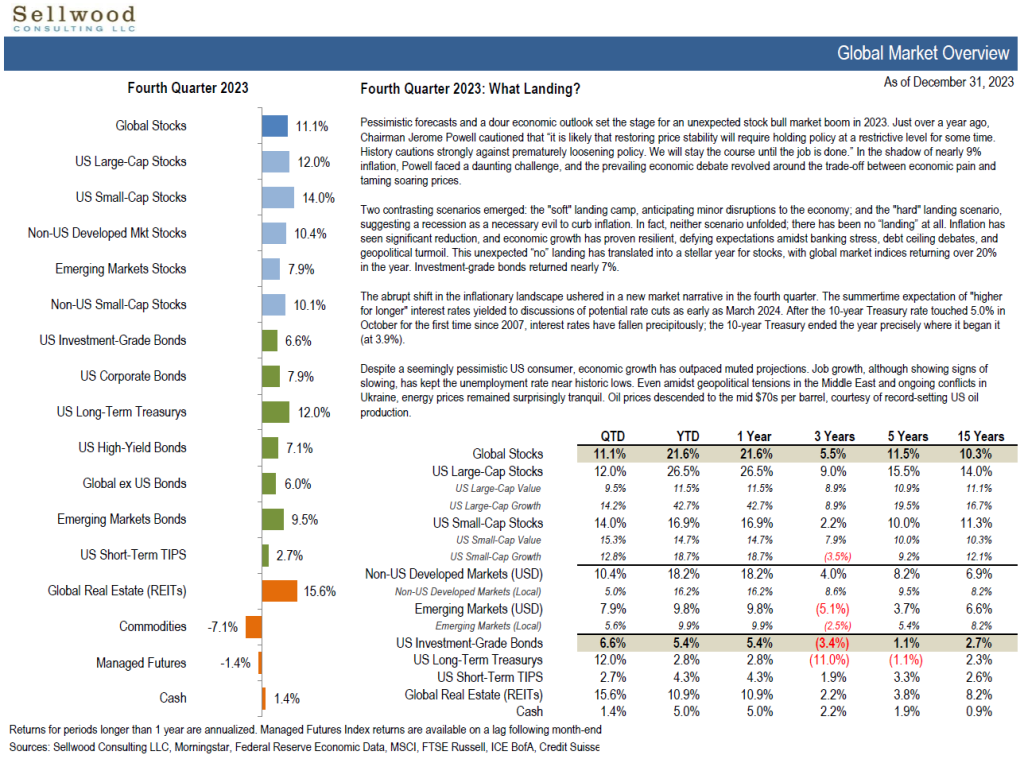

Fourth Quarter 2023 Market Snapshot

Pessimistic forecasts and a dour economic outlook set the stage for an unexpected stock bull market boom in 2023. Just over a year ago, Chairman Jerome Powell cautioned that “it is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

Happy Holidays

In the spirit of the Holiday Season, Sellwood has made a financial contribution to the Oregon Humane Society, where five of Sellwood’s staff members have adopted members of their families. The Oregon Humane Society recently celebrated a record 10,000th pet adoption in this calendar year. OHS offers a wide variety of services from pet adoption, training, humane law enforcement, veterinary care, humane education, and disaster response.

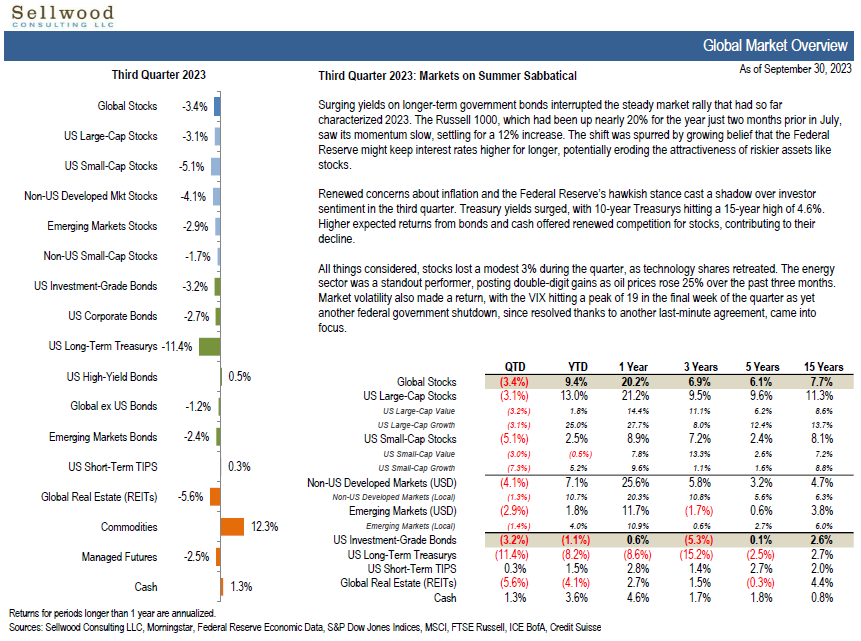

Third Quarter 2023 Market Snapshot

Surging yields on longer-term government bonds interrupted the steady market rally that had so far characterized 2023. The Russell 1000, which had been up nearly 20% for the year just two months prior in July, saw its momentum slow, settling for a 13% increase. The shift was spurred by growing belief that the Federal Reserve might keep interest rates higher for longer, potentially eroding the attractiveness of riskier assets like stocks.

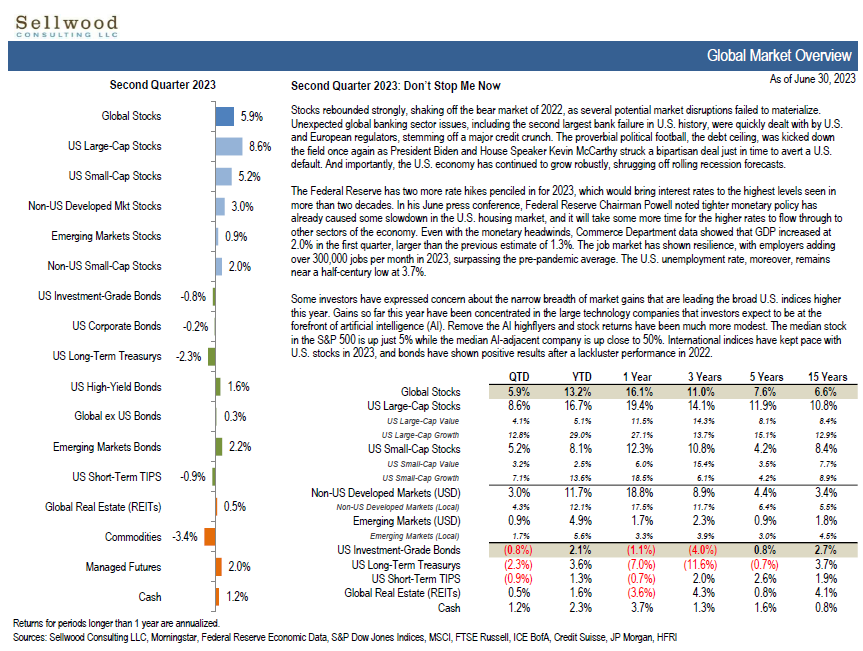

Second Quarter 2023 Market Snapshot

Stocks continued to advance, shaking off the bear market of 2022, as several potential market disruptions failed to materialize. Unexpected global banking sector issues, including the second largest bank failure in U.S. history, were quickly dealt with by U.S. and European regulators, stemming off a major credit crunch.

Bond Investing When the Yield Curve is Inverted

The Treasury yield curve remains persistently inverted, implying that short-term bonds offer higher expected returns than intermediate- or long-term bonds. Given this information, does it make sense for intermediate-term bond investors to seek those higher returns by shortening the duration of their bond portfolios?