Fourth Quarter 2024 Market Snapshot

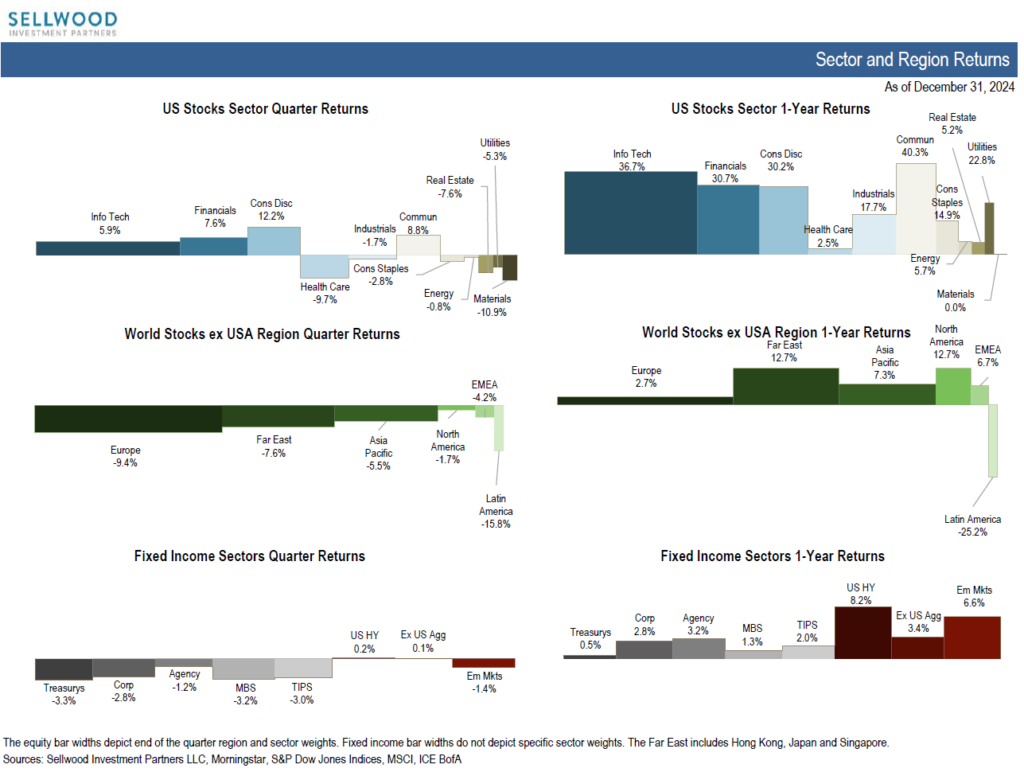

Download (PDF, 481KB) Fourth Quarter 2024: Saddle Up: The Magnificent Seven Ride Again, Leaving Others in the Dust Amid worrisome global turmoil, more modest rate cuts than anticipated, and a US election reversal, mega-cap tech giants powered the S&P 500 to 57 record closes in 2024, along the way to a 25% gain for the […]

Third Quarter 2024 Market Snapshot

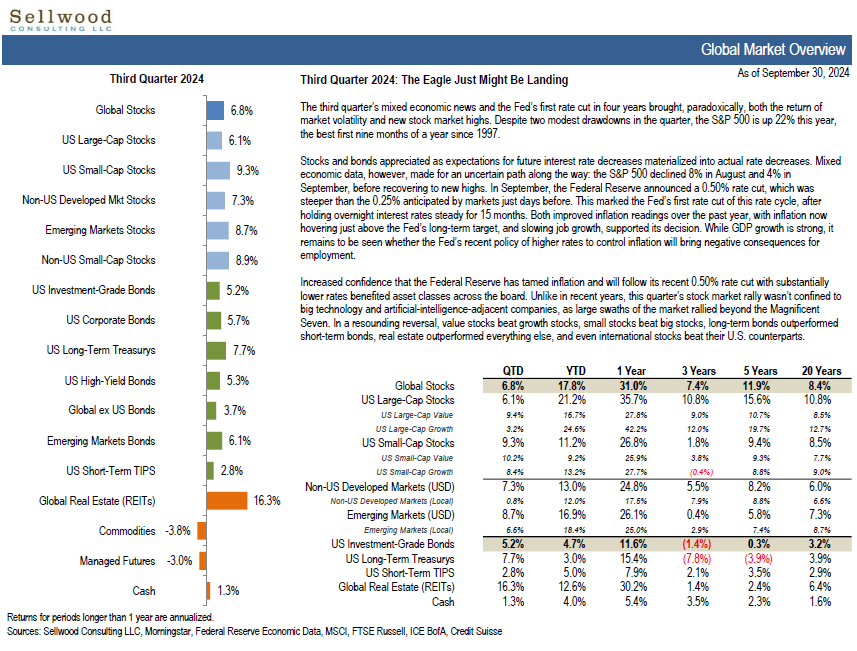

The third quarter’s mixed economic news and the Fed’s first rate cut in four years brought, paradoxically, both the return of market volatility and new stock market highs.

Second Quarter 2024 Market Snapshot

Second Quarter 2024: Artificial Intelligence or Artificial Highs? The second quarter of 2024 capped a strong first half of the year, with the artificial intelligence (“AI”) frenzy propelling stocks to gains despite a backdrop of tempered expectations for Federal Reserve interest-rate cuts. The S&P 500 climbed over 4% in the quarter and 15% in the

First Quarter 2024 Market Snapshot

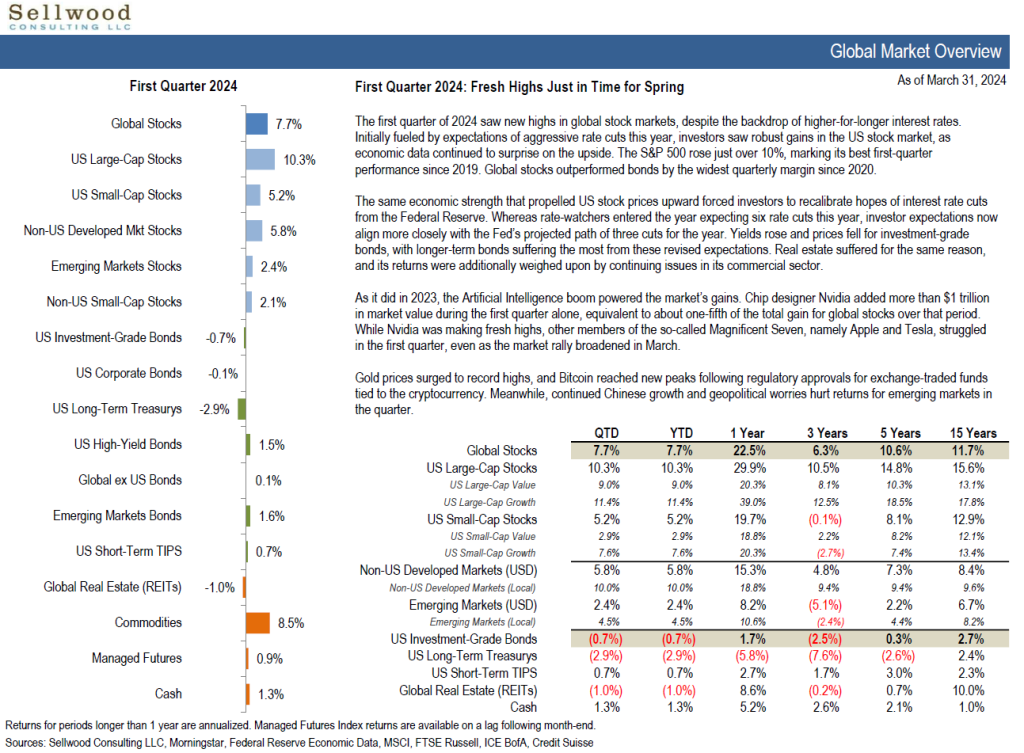

The first quarter of 2024 saw new highs in global stock markets, despite the backdrop of higher-for-longer interest rates. Initially fueled by expectations of aggressive rate cuts this year, investors saw robust gains in the US stock market, as economic data continued to surprise on the upside. The S&P 500 rose just over 10%, marking its best first-quarter performance since 2019. Global stocks outperformed bonds by the widest quarterly margin since 2020.

Fourth Quarter 2023 Market Snapshot

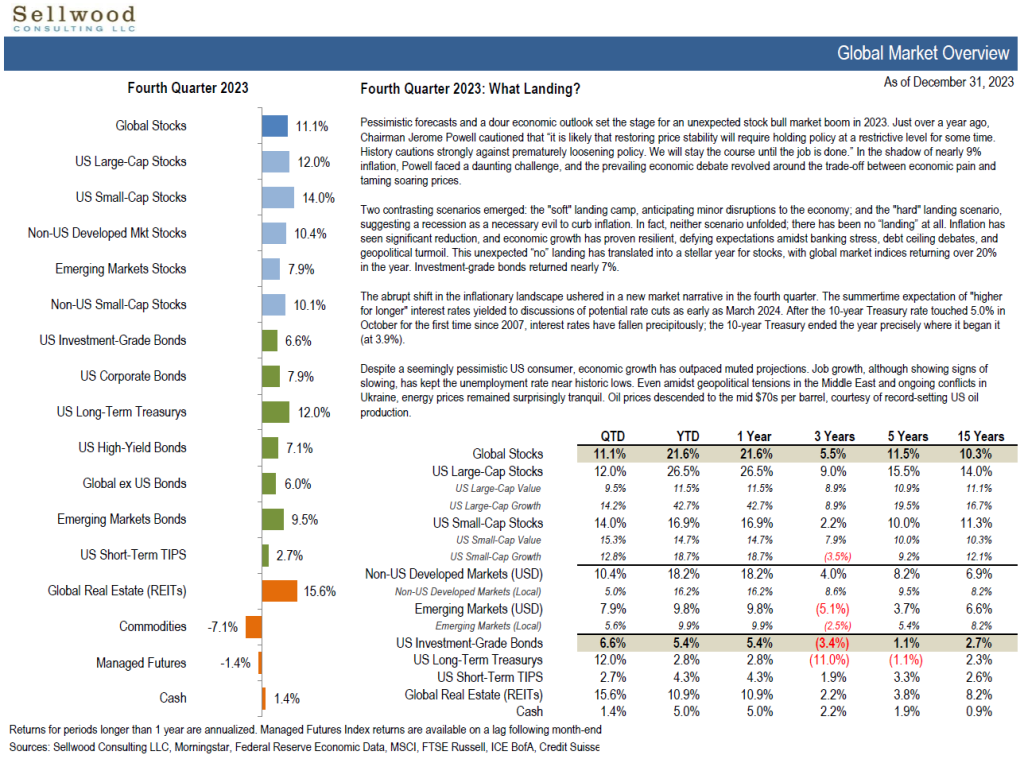

Pessimistic forecasts and a dour economic outlook set the stage for an unexpected stock bull market boom in 2023. Just over a year ago, Chairman Jerome Powell cautioned that “it is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

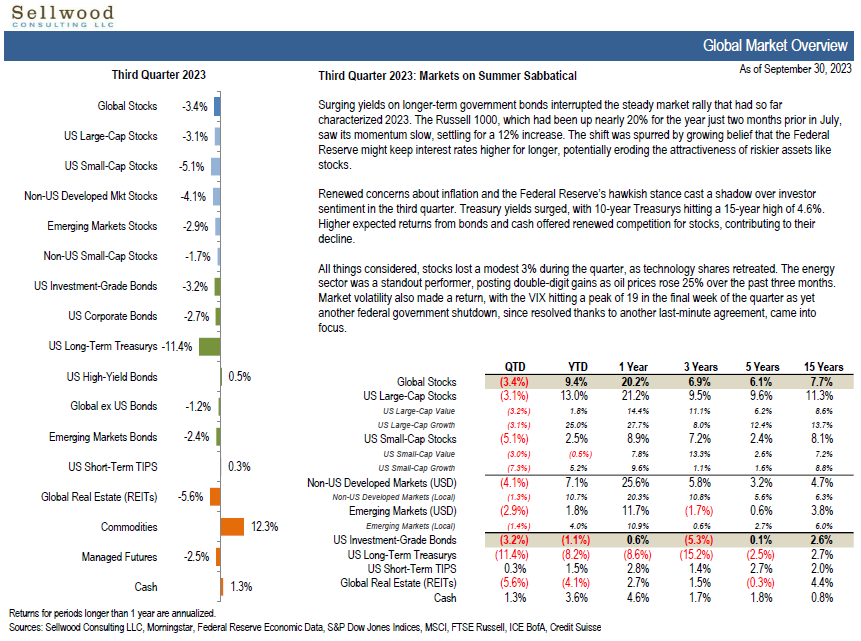

Third Quarter 2023 Market Snapshot

Surging yields on longer-term government bonds interrupted the steady market rally that had so far characterized 2023. The Russell 1000, which had been up nearly 20% for the year just two months prior in July, saw its momentum slow, settling for a 13% increase. The shift was spurred by growing belief that the Federal Reserve might keep interest rates higher for longer, potentially eroding the attractiveness of riskier assets like stocks.

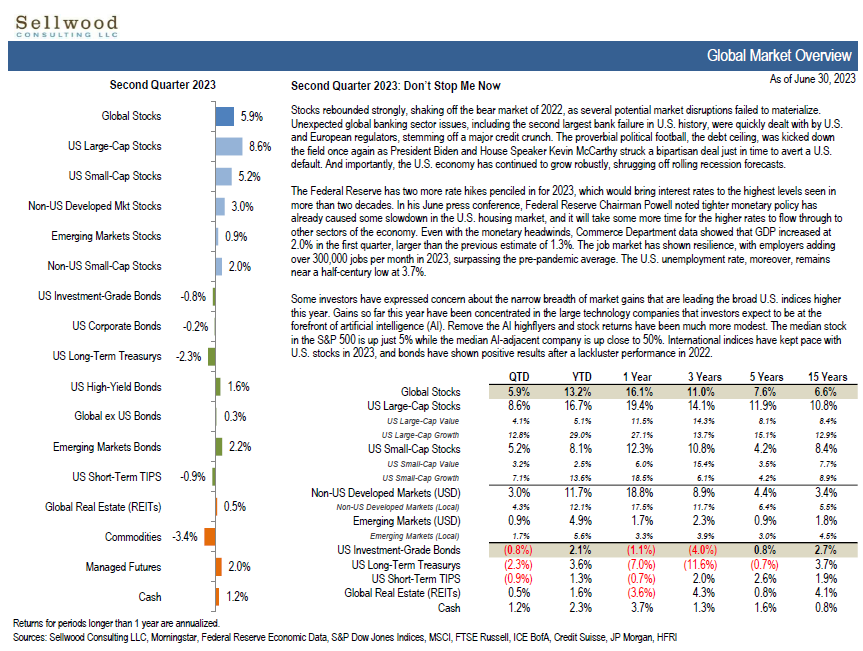

Second Quarter 2023 Market Snapshot

Stocks continued to advance, shaking off the bear market of 2022, as several potential market disruptions failed to materialize. Unexpected global banking sector issues, including the second largest bank failure in U.S. history, were quickly dealt with by U.S. and European regulators, stemming off a major credit crunch.

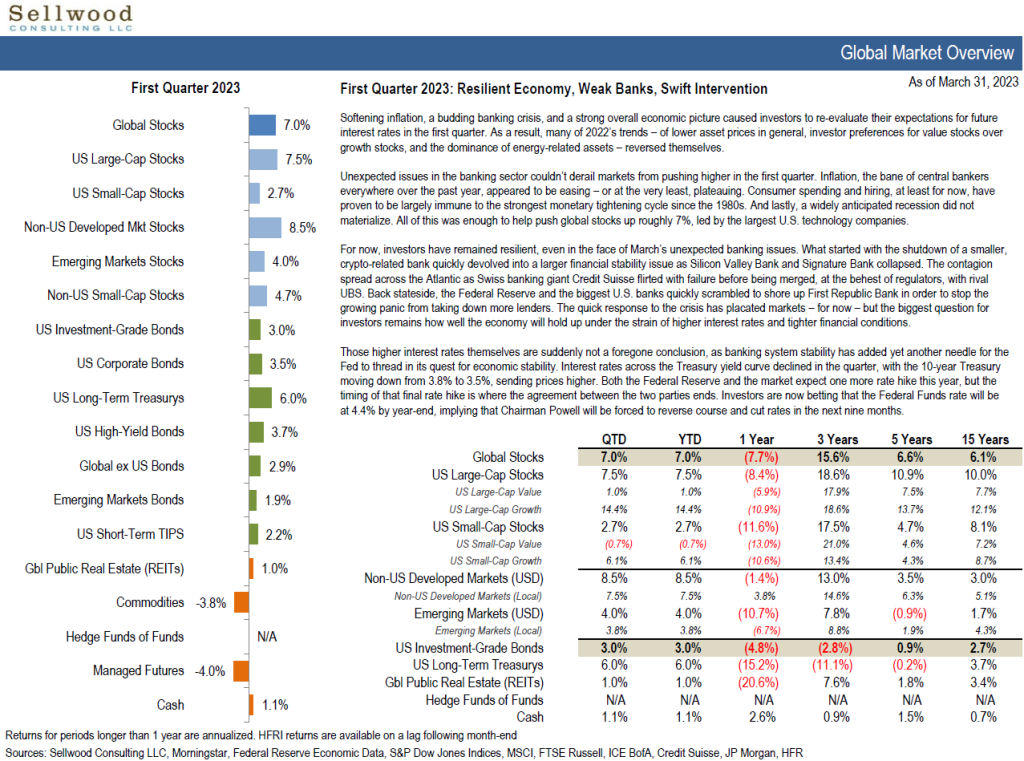

First Quarter 2023 Market Snapshot

Softening inflation, a budding banking crisis, and a strong overall economic picture caused investors to re-evaluate their expectations for future interest rates in the first quarter. As a result, many of 2022’s trends – of lower asset prices in general, investor preferences for value stocks over growth stocks, and the dominance of energy-related assets – reversed themselves.

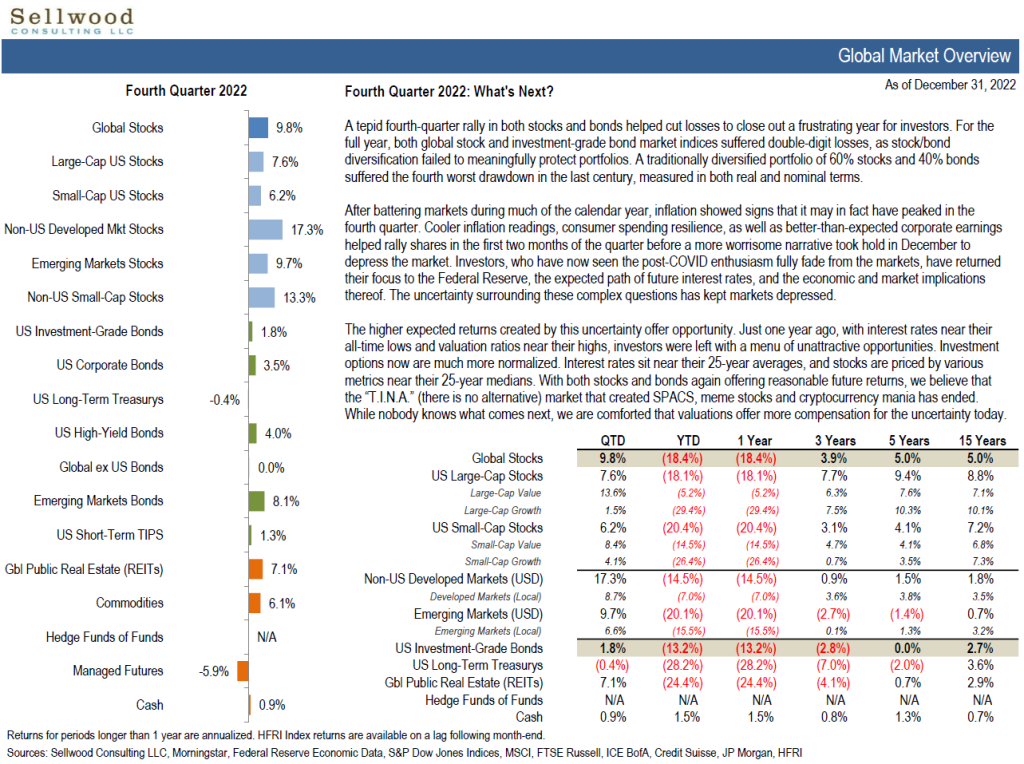

Fourth Quarter 2022 Market Snapshot

A tepid fourth-quarter rally in both stocks and bonds helped cut losses to close out a frustrating year for investors. For the full year, both global stock and investment-grade bond market indices suffered double-digit losses, as stock/bond diversification failed to meaningfully protect portfolios. A traditionally diversified portfolio of 60% stocks and 40% bonds suffered the fourth worst drawdown in the last century, measured in both real and nominal terms.