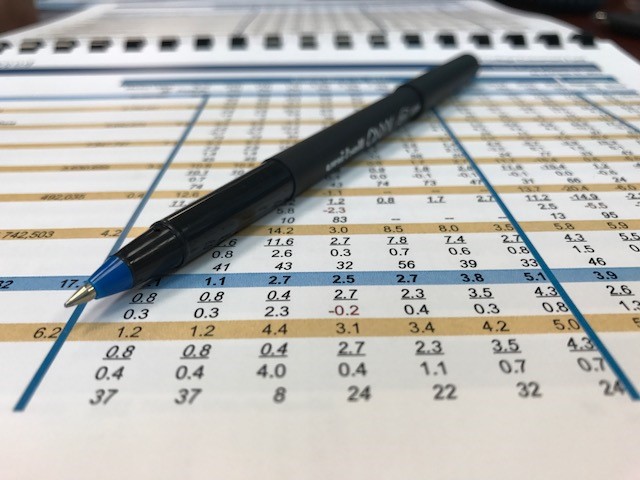

2025 Capital Market Assumptions

Download our 2025 Capital Market Assumptions Report. Sellwood’s 2025 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients. Our 2025 return and risk assumptions are presented below: We update our capital market assumptions annually. This year, we reduced […]

2024 Capital Market Assumptions

Sellwood’s 2024 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

The Magnificent Seven and Equity Market Concentration

In the 1960 film, “The Magnificent Seven,” an undersized group of seven gunfighters gallantly fought to liberate a small village from a gang of marauding bandits. As the movie’s advertising poster proclaimed, “they fought like seven hundred.”

Bond Investing When the Yield Curve is Inverted

The Treasury yield curve remains persistently inverted, implying that short-term bonds offer higher expected returns than intermediate- or long-term bonds. Given this information, does it make sense for intermediate-term bond investors to seek those higher returns by shortening the duration of their bond portfolios?

2023 Capital Market Assumptions

Sellwood’s 2023 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

2023 Investment Themes: Changing Narratives

The dozen years following the 2008-09 Global Financial Crisis can be separated into two distinct market narratives, both of which are currently being unwritten.

2022 Economic & Market Review

2022 was a brutal year for markets, offering few places to hide to novice and professional investors alike. As we transition to 2023, the following questions are top of mind:

Good and Bad Benchmarks

A portfolio’s benchmark is a tool that helps a client (asset owner) perform the essential governance function of monitoring the management of its portfolio. While a good benchmark will make this governance function easier, a bad benchmark will make it more difficult.

2022 Capital Market Assumptions

These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.Sellwood’s 2022 Capital Market Assumptions portray a more optimistic environment for most asset classes, compared to a year ago.

2021 Capital Market Assumptions

These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.