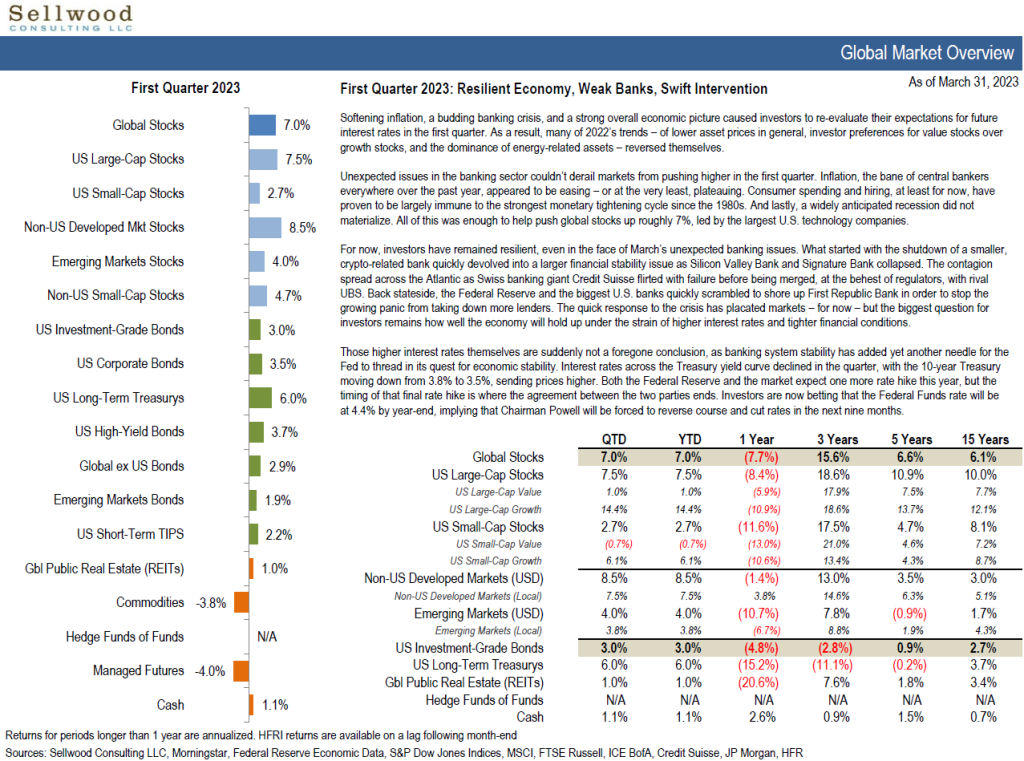

First Quarter 2023 Market Snapshot

Softening inflation, a budding banking crisis, and a strong overall economic picture caused investors to re-evaluate their expectations for future interest rates in the first quarter. As a result, many of 2022’s trends – of lower asset prices in general, investor preferences for value stocks over growth stocks, and the dominance of energy-related assets – reversed themselves.

2023 Capital Market Assumptions

Sellwood’s 2023 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

2023 Investment Themes: Changing Narratives

The dozen years following the 2008-09 Global Financial Crisis can be separated into two distinct market narratives, both of which are currently being unwritten.

2022 Economic & Market Review

2022 was a brutal year for markets, offering few places to hide to novice and professional investors alike. As we transition to 2023, the following questions are top of mind:

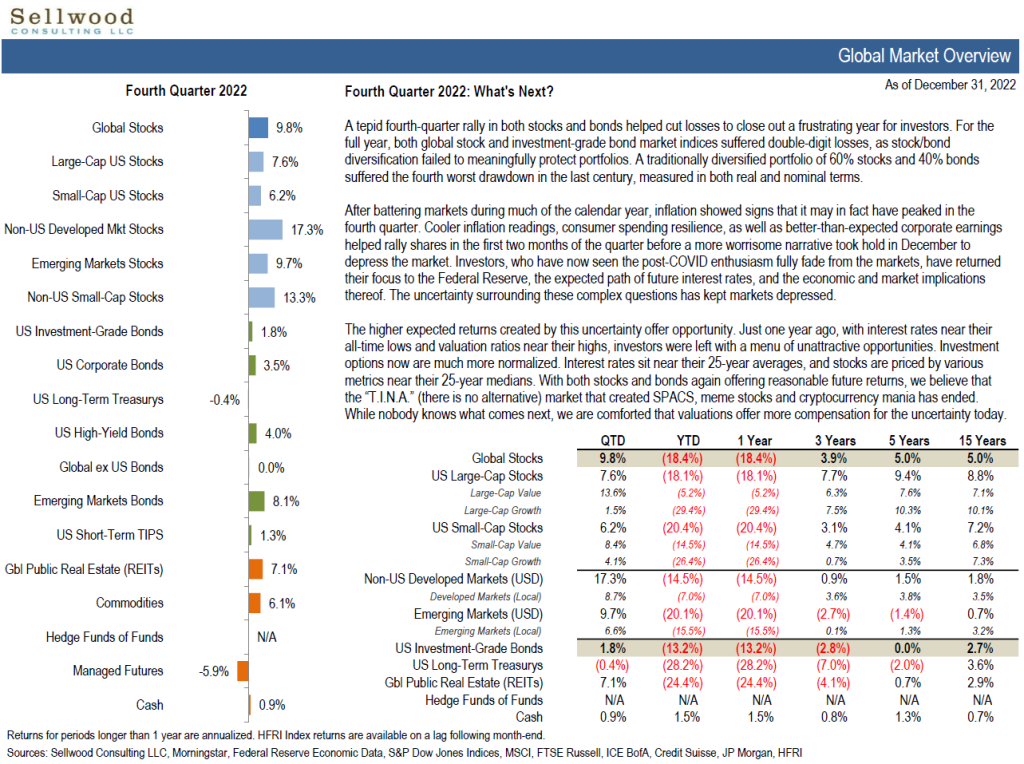

Fourth Quarter 2022 Market Snapshot

A tepid fourth-quarter rally in both stocks and bonds helped cut losses to close out a frustrating year for investors. For the full year, both global stock and investment-grade bond market indices suffered double-digit losses, as stock/bond diversification failed to meaningfully protect portfolios. A traditionally diversified portfolio of 60% stocks and 40% bonds suffered the fourth worst drawdown in the last century, measured in both real and nominal terms.

Happy Holidays

In the spirit of the Holiday Season, Sellwood has made a financial contribution to the Community Transitional School, a non-profit organization that provides homeless and transient children with a stable educational environment that promotes their academic and personal growth.

Celebrating a Decade of Small Batch Portfolios

Ten years ago, Sellwood’s four founders opened the firm’s doors in a little office in Portland. At the time, we had no clients, no track record, and no assets to advise. But what we lacked in resources, we made up for in a strong vision for a different type of institutional advisory firm.

Good and Bad Benchmarks

A portfolio’s benchmark is a tool that helps a client (asset owner) perform the essential governance function of monitoring the management of its portfolio. While a good benchmark will make this governance function easier, a bad benchmark will make it more difficult.

2022 Capital Market Assumptions

These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.Sellwood’s 2022 Capital Market Assumptions portray a more optimistic environment for most asset classes, compared to a year ago.

Sellwood Joins Institutional Investing Diversity Cooperative

For a long time, a lack of good data has prevented diverse investment managers from being hired by institutional clients. That’s about to change, due to the efforts of the Institutional Investing Diversity Cooperative, which Sellwood recently joined.